A down payment is money that is required upfront from the buyer towards the home they want to purchase with financing from a mortgage loan. Buyers can put anywhere between 3% and 20% of the purchase price down, depending on the terms of their loan.

Closing costs are the fees associated with the cost of a home purchase and are due at the time of closing on your home. These average between 2% – 7% of the home’s purchase price.

Covering these upfront costs can be a barrier to homeownership for many households. NeighborWorks Green Bay and other community programs have various purchase assistance programs that can help.

NEIGHBORWORKS GREEN BAY PROGRAMS

blank

NeighborWorks Loan Fund (NLF)

Loan of up to $7,000 towards the down payment and closing costs. This is a loan that is required to be paid back. It has no interest and no monthly payments. Due back when the home is sold, ownership changes, home is no longer owner-occupied, or in some instances of refinancing. This loan requires a home inspection performed by a state certified home inspector. Location and income limits apply.

Housing Cost Reduction Initiative (HCRI)

Loan of up to $7,500 towards the down payment and closing costs. This is a loan that is required to be paid back. It has no interest and no monthly payments. Due back when the home is sold, ownership changes, home is no longer owner-occupied, or in some instances of refinancing. This loan requires a housing qualify standards (HQS) home inspection performed by NeighborWorks Green Bay. Location and income limits apply.

HOME

Loan of up to $15,000 towards the down payment and closing costs. This is a loan that is required to be paid back. It has no interest and no monthly payments. Due back when the home is sold, ownership changes, home is no longer owner-occupied, or in some instances of refinancing. This loan requires a housing qualify standards (HQS) home inspection performed by NeighborWorks Green Bay. Location and income limits apply.

American Foods Employer Assisted Homeownership

- Only eligible to American Foods Group employees.

- Forgivable loan of up to $7,500. It has no interest and no monthly payments. Forgiven on an annual basis and will be completely forgiven after either 3 or 4 years. Could be due back if the home is sold, ownership changes, home is no longer owner-occupied, or in some instances of refinancing before term is up. This forgivable loan requires a home inspection performed by a state certified home inspector.

Services Plus Employer Assisted Homeownership

- Only eligible to Services Plus employees.

- Forgivable loan of $5,000. It has no interest and no monthly payments. Forgiven monthly and will be completely forgiven after 5 years. Could be due back if the home is sold, ownership changes, home is no longer owner-occupied, or in some instances of refinancing before 5 years. This forgivable loan requires a home inspection performed by a state certified home inspector.

COMMUNITY PROGRAMS

There are a variety of other options for down payment and closing cost assistance throughout the community. Clients may qualify for other programs. Information on those community programs is below.

blank

Down Payment Plus (DPP)

- Only eligible to Federal Home Loan Bank of Chicago Members who have Down Payment Plus Agreements.

- Forgivable loan of up to $10,000 towards the down payment and closing costs. It has no interest and no monthly payments. Forgiven monthly and will be completely forgiven after 5 years. Could be due back if the home is sold, ownership changes, home is no longer owner-occupied, or in some instances of refinancing before 5 years. This forgivable loan does not require a home inspection. Location and income limits apply.

- More information

Northeast Wisconsin Housing CDBG Loan Program

- Can help with down payment or home repairs. Eligible within Brown, Calumet, Door, Fond du Lac, Kewaunee, Manitowoc, Marinette, Outagamie, Sheboygan, and Winnebago counties. Please contact Brown County Planning and Land Services for more information.

- More information

Housing Choice Voucher Homeownership Program

- Only eligible to buyers who currently have a Housing Choice Voucher. Please contact Integrated Community Solutions for more information.

- More information

Appleton Housing Authority Homebuyer Program

- Can help with down payment or home repairs. Only eligible to buyers who are purchasing in Outagamie or Calumet County. Please contact Appleton Housing Authority for more information.

- More information

Habitat for Humanity

- Homeownership program which assists buyers with their primary mortgage, down payment assistance, and home build. Please contact your local Habitat for Humanity for more information.

- More information

NEWCAP Homebuyer Program

- Can help with down payment and closing costs. Please contact NEWCAP for more information.

- More information

Wisconsin Housing and Economic Development Authority (WHEDA)

- WHEDA provides affordable Conventional and FHA primary mortgages, along with down payment and closing cost assistance. Please see website here for more information.

- More information

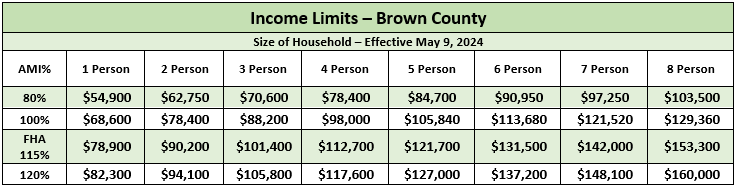

INCOME LIMITS

Purchase assistance programs have income limits that must be met. To determine a household’s income, NeighborWorks Green Bay will use the household’s size and the entire household’s income. This means that we will collect income documents for household members who may not be on the mortgage loan. Income limits are determined by the Federal Government and are updated annually.

Income limits for other programs can be found on their individual websites.

HOW TO READ THE CHART ABOVE:

- Determine the number of people who will be living in your household when you purchase.

- Determine the annual income of all members in your household including:

- Full-time or part-time wages.

- Self-employment.

- Social security income.

- Disability income.

- Find your household size and view the annual income limits between 80% and 120%.

- If you are under the annual income for 120% of the area’s median income (AMI) you may be eligible for programs from NeighborWorks Green Bay.

- If you are under the annual income for 80% of the area’s median income (AMI) you may be eligible for even more programs from NeighborWorks Green Bay or other community sources.

Interest Form

Once you fill this form out, NeighborWorks Green Bay staff will be in touch with you within 2 business days with your next steps.